A YEAR FOR OPTIMISM AND EXPANSION?

52% of CEO’s believe the global economy will be better in 2017, compared to only 27% who anticipated economic improvement a year ago (PricewaterhouseCoopers).

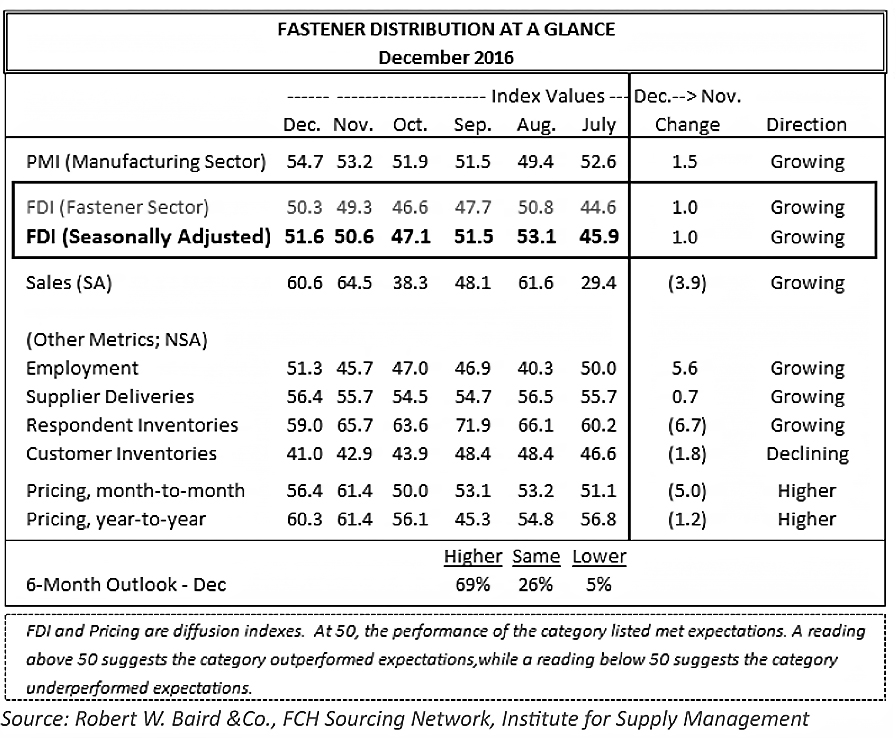

In North America, The Fastener Distributor Index (FDI) signals an overall positive stance. December’s seasonally adjusted FDI reached 51.6, up 1-point from November, and hit the second highest mark of 2016, behind August’s 53.1.

NEWS & HIGHLIGHTS

In the January edition of the Fully Threaded Podcast, analyst Dave Manthey discusses the fastener industry outlook for 2017, and the latest FDI* & PMI* results, with host Mike McNulty of Fastener Technology International.

- Private companies are generally more optimistic, but still taking a wait-and-see approach before making capital investments and allocations to fuel additional growth.

- Durable goods manufacturing showing activity and inflecting slightly higher, particularly with: gas & welding supplies; metal working; cutting tools; general industrial maintenance, repair, & operations.

- Residential construction should expect healthy growth in: building & maintenance products and facility maintenance.

- Non-residential construction expecting modest growth in 2017

- Institute for Supply Management PMI at 54.7, up for the 4th month in a row and reaching highest level since late 2014 e.g. New Orders and Production Components.

- The FDI displays sawtooth graph results with figures going above and below 50. However, in the last 6 months, 4 were above 50, indicating conditions are better exiting the year than starting the year.

- There is potential for inflationary pro-growth policies and infrastructure spending driven by the Trump administration, speculates Manthley.

- 4% increase in spending on construction, year over year (YOY) from November.

- 8% increase in residential YOY. Single family housing now outpacing multifamily, reversing the recent trend from last year.

- 95% of survey respondents expected the FDI to be the same or higher in 6 months – a lot of optimism.

- 67% experienced better or improved sales YOY.

- 10% increase in hiring YOY.

- 17,000 jobs added in domestic manufacturing.

- Concerns

- – 10% in manufacturing structures.

- – 0.6% in industrial production YOY, which is the 15th negative reading since September 2015.

- 75% capacity utilization.

- Weakness among motor vehicles and machinery.

- Still, the US economy is fairly healthy

- 3.5% increase in GDP from 3rd quarter.

- Regional Fed Surveys show positive results.

- 5% unemployment rate.

Fastener Distributor Index – December 2016. Download the report here.

*FDI: The Fastener Distribution Index (FDI) is a monthly survey of North American fastener distributors offering insights into current trends and outlooks. It operates as a diffusion index, meaning figures above 50 signal strength, while figures below 50 signal weakness. Over time this should correlate well with what is going on in the fastener industry.)

*PMI: The Purchasing Managers’ Index (PMI) is an indicator of the economic health of the manufacturing sector. The PMI is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.